The Psychology of FOMO: How to Avoid Impulsive Investment Decisions

Unlocking the secrets to successful investing in the age of FOMO

If you’ve ever felt the fear of missing out (FOMO), you know how powerful that feeling can be. When it comes to investing, however, FOMO can be a dangerous driver of impulsive decisions that can harm your long-term financial goals. In this post, we’ll explore the dangers of FOMO and how to avoid making impulsive investments.

The Dangers of Following the Crowd

One of the main dangers of FOMO is that it can lead you to ignore your own investment strategies and follow the crowd. This can result in a classic case of “buying high and selling low,” as you may buy in at a peak and panic sell when the market dips. This can be particularly damaging to your long-term financial goals, as it can erode your investment returns over time.

Real-world example: Bitcoin is a good example of how FOMO can lead to impulsive investments. In 2017, the price of Bitcoin skyrocketed from $1,000 to nearly $20,000. Many investors jumped on the bandwagon, hoping to make a quick profit. However, when the price of Bitcoin crashed in early 2018, many of these investors panicked and sold at a loss.

The Danger of Taking on Too Much Risk

Another danger of FOMO is that it can lead you to take on too much risk. When you’re focused on the potential rewards of an investment, you may overlook the risks involved and fail to diversify your portfolio. This can leave you vulnerable to market downturns or unexpected events that can wipe out your savings.

Real-world example: During the dot-com bubble of the late 1990s, many investors poured money into tech stocks, hoping to cash in on the latest tech innovations. However, when the bubble burst in 2000, many of these investors lost a significant portion of their investments.

How to Avoid FOMO and Make Rational Investment Decisions

To avoid falling victim to FOMO and making impulsive investments, there are a few strategies you can use:

Develop a Solid Investment Plan: Develop a clear roadmap for your investments that aligns with your goals and risk tolerance. By having a solid plan, you can avoid being swayed by short-term market fluctuations or peer pressure.

Practice Mindfulness and Self-Reflection: Before making an investment, take a moment to check in with yourself and ask if this decision aligns with your values and goals. If you feel like you’re making a decision out of fear or anxiety, it may be a sign that you need to step back and re-evaluate your strategy.

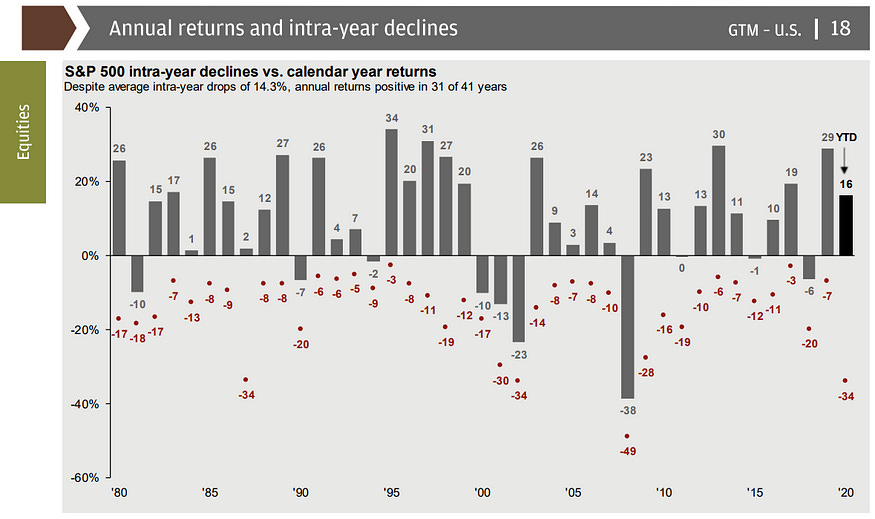

Take a Patient and Disciplined Approach: Investing is a long-term game. Trying to time the market or make quick profits can be tempting, but it’s rarely a winning strategy. By taking a patient and disciplined approach, you can weather short-term fluctuations and stay focused on your long-term goals.

The role of diversification in overcoming FOMO

One effective way to overcome FOMO is by diversifying your investments. Diversification involves investing in a variety of assets that have low correlation with one another. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the risk of losing all your money in one investment.

Since 1974, the S&P 500 has risen an average of more than 8% one month after a market correction bottom and more than 24% one year later. — David Koenig, Charles Swab Intelligent Portfolios

For example, let’s say you have $10,000 to invest, and you’re considering putting it all into a hot tech stock that everyone is talking about. However, if you diversify your investment and put $5,000 into the tech stock and $5,000 into the S&P 500 index, you reduce the risk of losing all your money if the tech stock crashes. Even if the tech stock drops, you still have some money invested in the bond fund, which may provide a cushion to your overall portfolio.

Of course, diversification alone won’t guarantee profits or protect you from all losses, but it can help you avoid the danger of putting all your eggs in one basket. Remember, it’s important to have a long-term investment strategy that’s tailored to your goals, risk tolerance, and time horizon.

Sneak Peek: In the next post, we will discuss the power of positive thinking and how it can help you overcome negativity bias when making financial decisions. By understanding the ways in which our brains can lead us astray, you can develop strategies to stay focused on the positive and avoid getting derailed by negative thoughts.

Disclaimer: The information presented in this post is for educational purposes only. Please consult with your financial advisor before making any investment decisions.

Sources:

“Fear of Missing Out (FOMO): The Psychology Behind the Phenomenon” by Verywell Mind

“FOMO, Social Comparison, and Financial Behavior” by The Journal of Behavioral Finance

“How FOMO Is Driving Investors to Bitcoin and Other Crypto-assets”